In 2018 consumers will spend 124 bn dollars on pets worldwide, an increase in expenditure of 6.8 per cent compared with 2017. The pet food segment, the biggest segment in the sector, will account for two thirds of the pet product market at 90 bn dollars. These figures come from a recent study by market research company Euromonitor International.

China will be the fastest-growing market between 2018 and 2023 with 20 per cent growth. While the USA is the biggest pet supplies market globally, the study by Euromonitor indicates that Great Britain, which has a sales volume of over 6 bn dollars in 2018, constitutes the biggest market in Europe.

US market booming

Paula Flores, head of pet care research at Euromonitor International, has the following comment on this trend: "Pet food is an area in which the top 5 companies account for 41 per cent of global sales. This is impressive and different from other CPG* sectors." Nevertheless, the market has changed considerably in the last few years, with new suppliers joining the established top players. The US pet food company Blue Buffalo, for example, has been writing its own success story, reflected in remarkable statistics in the form of 138 per cent growth in the last five years.

Just recently the dog food brand named after American television presenter Rachael Ray has achieved astounding success and was one of the fastest-growing brands in 2017. This spring, the manufacturer of this brand, Ainsworth Pet Nutrition, was bought for 1.9 bn dollars by grocery giant J.M. Smucker.

Cat population growing

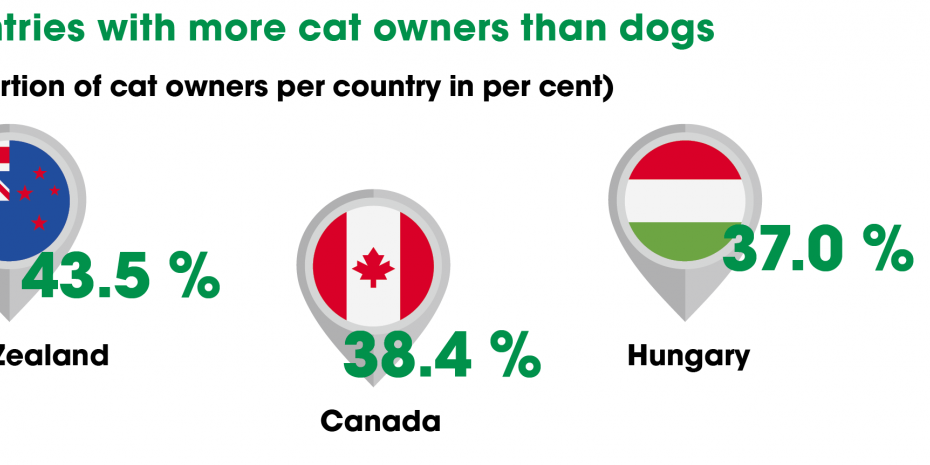

Although more sales are generated globally by dog food than by cat food, the cat population has overtaken the dog population by a sizeable margin in many countries. Experts put this trend down to growing urbanisation, as cats are more independent and thus easier to keep than dogs, and so fit in better with life in the city. This trend is reflected according to Euromonitor not only in the sale of cat treats, but also cat food. The cat food category has also experienced a high degree of premiumisation, resulting in the appearance of more nutritious cat food. An increasing number of alternative protein sources are being used in production, and many products now offer additional health benefits. Global sales of premium cat food are projected to grow in 2018 by 4 per cent and attain a volume of 2 bn dollars by 2023.

Growing at a slower pace

Pet humanisation and premium products drove global pet care sales up by 5.9 per…

Menü

Menü

5/2018

5/2018

Newsletter

Newsletter