Inflation and diminishing disposable income pose the biggest challenges to consumers and manufacturers, coinciding as they do with a decline in the pent-up demand following the pandemic. “The pet sector is a recession-resistant but not a recession-proof segment,” explained Tommaso Cappato, research analyst at Euromonitor International, on the podium in Bologna. In other words, although the pet sector will be affected by the consequences of inflation, global warming and of course the war in Ukraine, the impact will not be enough to trigger a downward economic trend.

Strong influences

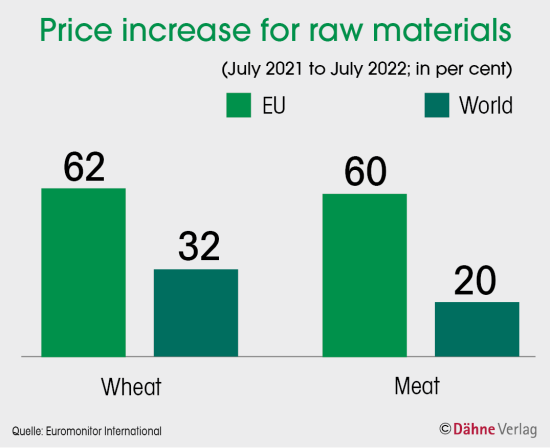

The Russian war of aggression in Ukraine has influenced the availability and price of raw materials in particular. Cappato reported on a rise in wheat prices of 62 per cent in the EU and 32 per cent globally seen in the period from July 2021 to July 2022. A very similar trend was observed with regard to meat over the same period, with Euromonitor analysts determining an increase of 60 per cent in the EU and 20 per cent worldwide.

Added to this are the consequences of global warming. “The years 2015-2019 were the five warmest years since records began, while 2010-2019 was the warmest decade since records began,” emphasised Cappato. He pointed out here that climate change will change the global food supply. Up to 2020, the Food Policy Research Institute forecast a decline of 24 per cent in the volume of corn, three per cent for wheat, eleven per cent for rice and nine per cent for potatoes. In 2022, low water levels were already resulting in drought conditions in Europe. In addition, heatwaves and torrential rain caused yields to fall substantially.

What about the pet sector?

Cappato assumed that the trend towards premiumisation observed during the Covid-19 pandemic would not last in a situation that remained recessive over a longer period. On the contrary, the analyst believed that the medium price segment would be reinvigorated and customers would focus more closely on price promotion campaigns.

“Diversified unit price increases could benefit pet product retailers,” said Cappato. It was expected that supermarkets would experience a decline in sales compared with speciality retailers such as pet stores and pet supermarkets. In the long term, the analyst expected the pet…

Menü

Menü

1/2023

1/2023

Newsletter

Newsletter