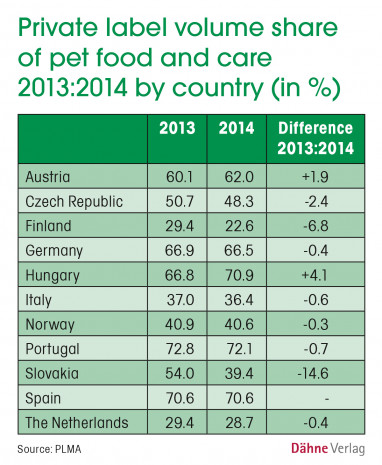

With a few negative exceptions, private label products for pets played an important role in the European pet supplies market once again last year, according to the annual report of the Private Label Manufacturers Association (PLMA). According to the association's yearbook containing figures supplied by the Nielsen market research company, retailers' brands increased in terms of volume in four of 14 European countries. In the other ten countries studied, there was only a slight downward movement compared with the previous year, with three exceptions. The biggest decline in volume came in Slovakia, where the market share in terms of volume was 39.4 per cent in 2014, signifying a drop of 14.6 per cent compared with the previous year. The second loser in the private label market was Finland, where the share of private label products fell in terms of volume by 6.8 per cent to 22.6 per cent in 2014. The country in which private label achieved the biggest share of the pet supplies market in 2014 was Hungary, where the market share in terms of volume rose to 70.9 per cent in 2014. This is equivalent to an increase of 4.1 per cent compared with 2013. The market share in terms of volume also increased in Austria, where the value rose from 60.1 per cent in 2013 to 62 per cent in 2014.

Petz Group delivers resilient 3Q25

Petz Group has reported another quarter of resilient growth, reinforcing its position as Brazil’s leading pet ecosystem. Third-quarter 2025 …

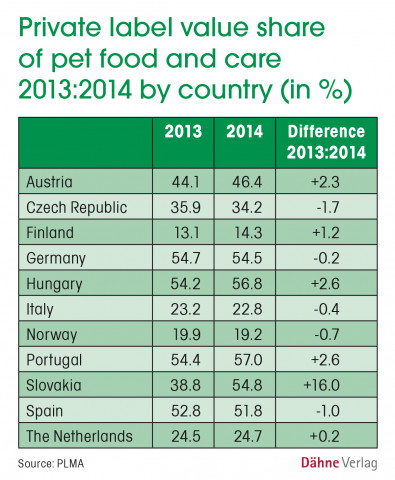

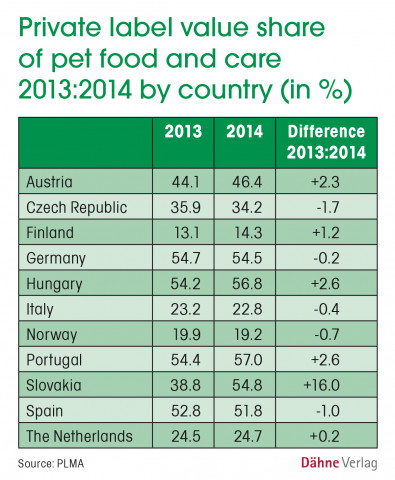

Sales volume mostly increases

In the countries where the private label market share was down most, Slovakia and Finland, the negative changes in private label volume share were not only balanced out by the sales figures, but were even turned to good account. In Slovakia, the sales figures for private label products increased by 16 per cent to 54.8 per cent in 2014. The loss in volume share was also turned around in the sales figures in Finland, which rose by 1.2 per cent compared with 2013 to 14.3 per cent. An increase in the sales figures was also reported in Hungary, where private labels grew their share compared with 2013 by 2.6 per cent to 56.8 per cent.