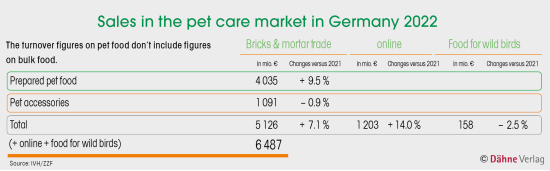

Despite a troubled economic backdrop, the German pet supplies sector has maintained its high sales level of previous years and the positive trend continues. Data from the Industrial Association of Pet Care Producers (Industrieverband Heimtierbedarf, IVH) and the German Pet Trade & Industry Association (Zentralverband Zoologischer Fachbetriebe (ZZF)) puts total turnover last year at nearly 6.5 bn euros. Sales of pet food in pet stores and supermarkets surpassed the previous year’s figure by 9.5 per cent, totalling 4.035 bn euros. The pet requisite and accessories segment, on the other hand, saw sales fall by 0.9 per cent in 2022 to 1.091 bn euros.

“While food sales remained largely stable, the increase in sales is mainly due to current inflation,” says IVH chairman Georg Müller. “Like manufacturers of other products in daily use, pet food producers have had to raise their prices on account of some huge cost increases for energy, packaging and logistics.”

“Retailers experienced steady demand from pet owners for pet food and other items essential to day-to-day living, such as cat litter. But when it came to equipment and accessories such as scratching posts, enclosures or technical products, the impact of the tight financial situation was felt increasingly by many consumers in 2022, who reined in their spending,” says ZZF president Norbert Holthenrich.

Cat food market dominates

With sales totalling 2.011 bn euros in stationary retail, equivalent to an increase of 12.5 per cent compared with the previous year, the market for cat food remained the biggest food segment in 2022. The moist food category experienced a growth rate of 13.6 per cent (1.329 bn euros), overtaking the category covering treats and cat milk, which grew by 11.8 per cent (326 mio euros), as the strongest growth driver for the first time in years. The dry food category likewise recorded strong growth (356 mio euros, up by 9.4 per cent).

The dog food market continued to grow in 2022, with an increase in sales of 7.8 per cent to 1.807 bn euros in classic distribution channels. In this segment also, the strongest growth shifted in the direction of moist food. This recorded the most marked increase, up by 13.4 per cent to 595 mio euros, followed by dry food (516 mio euros, up by 7.4 per cent) and treats (696 mio euros, an increase of 3.6 per cent).

Slight downturn in wild bird food

In-store sales of food for…

Menü

Menü

3/2023

3/2023

Newsletter

Newsletter