Fediaf puts the average growth rate of the European pet food industry between 2016 and 2019 at around 2.6 per cent. 85 mio households are currently believed to have a pet, equivalent to roughly 35 per cent of all households in Europe. Approximately 100 000 people are directly employed in the pet supplies sector, plus another 900 000 or so indirectly, for example as component suppliers or service providers.

From the industry viewpoint, Fediaf cites a figure of 132 pet food companies with around 200 factories in Europe. The annual quantity of pet food produced in Europe is 8.5 mio tonnes, according to Fediaf, with sales totalling 21 bn euros.

Fediaf has determined the overall sales value of pet products and services at 189.7 bn euros, with products accounting for 8.7 bn euros.

Focus on dogs and cats

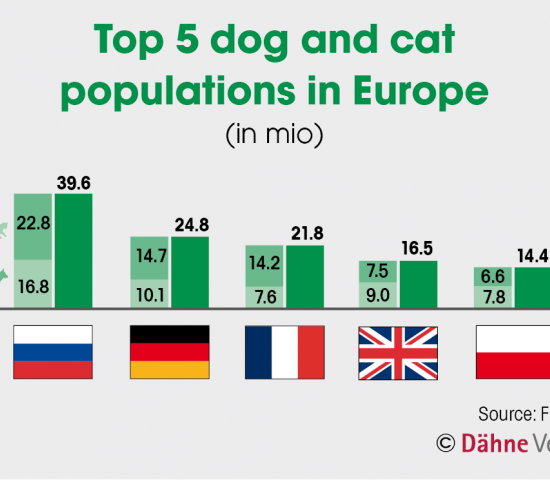

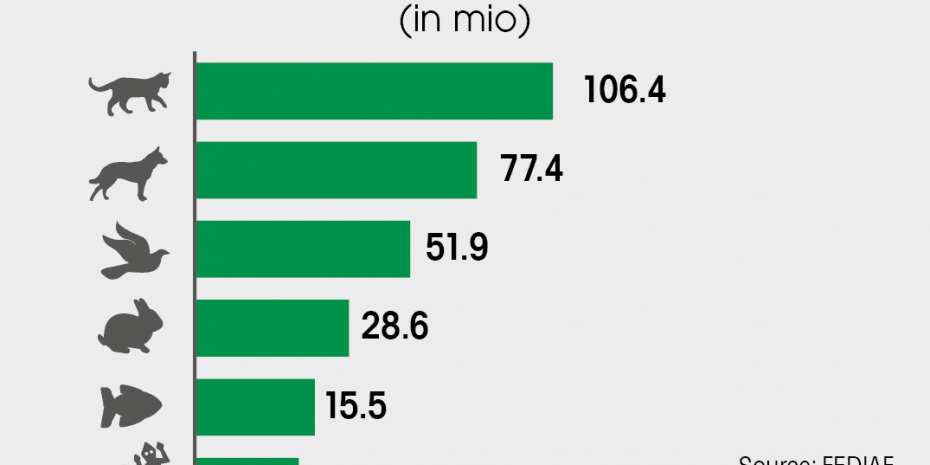

In the 28 European countries surveyed by Fediaf, either dogs (total in Europe: 77.4 mio) or cats (106.4 mio) top the list in 14 countries when it comes to the number of households with a pet.

Petfood Forum Europe returns

Petfood Forum Europe will officially return to Nuremberg in 2026 and take place on 11 May– just in time for Interzoo. With a multifaceted program and …

It is striking in this regard that in southern, northern and eastern European countries in particular, dogs are recorded in the majority of households. A particularly large difference exists in Austria, where cats reside in 30 per cent of households, but dogs are present in just 13 per cent. In Ireland, on the other hand, 35 per cent of households have at least one dog, but just 16 per cent of households have cats. Households with dogs or cats are virtually on a par in Greece, the United Kingdom, Romania and Finland among other countries.

Fediaf has determined that Russia has the largest number of dogs at 16.8 mio, whereas the smallest canine population is 230 000 in Estonia. Likewise, there are reportedly 22.8 mio cats in Russia, but 285 000 cats in Estonia. A direct correlation with population size cannot be denied.

Source: Fediaf

Menü

Menü

4/2020

4/2020

Newsletter

Newsletter